Important Tax Information

U.S. law requires that you pay federal, state, and local taxes. Generally, your employer will deduct money from your paycheck every pay period. As an income-earning individual, you will be taxed on income from salaries, wages, and tips. Your employer will submit the amount withheld directly to the federal government. Deductions for state and local taxes will vary. Some states do not have a personal income tax; others may tax income as much as 8%. Similarly, local taxes will vary but will be significantly less. If no taxes are withheld from your pay, please contact InterExchange.

You do pay:

- Federal income tax

- State income tax

- Local or city income tax

You do not pay:

- Social Security (S.S.)

- Medicare tax (FICA)

- Federal Unemployment Tax (FUTA)

If you see deductions that say FICA, FUTA, S.S. or Social Security, please notify your employer promptly. If your employer is unable to issue a refund, contact the Internal Revenue Service Center and request IRS Form 843 Claim for Refund and Request for Abatement. You will need to submit the completed IRS forms to the Internal Revenue Service Center. Please note: some states may deduct state unemployment taxes, which you are required to pay.

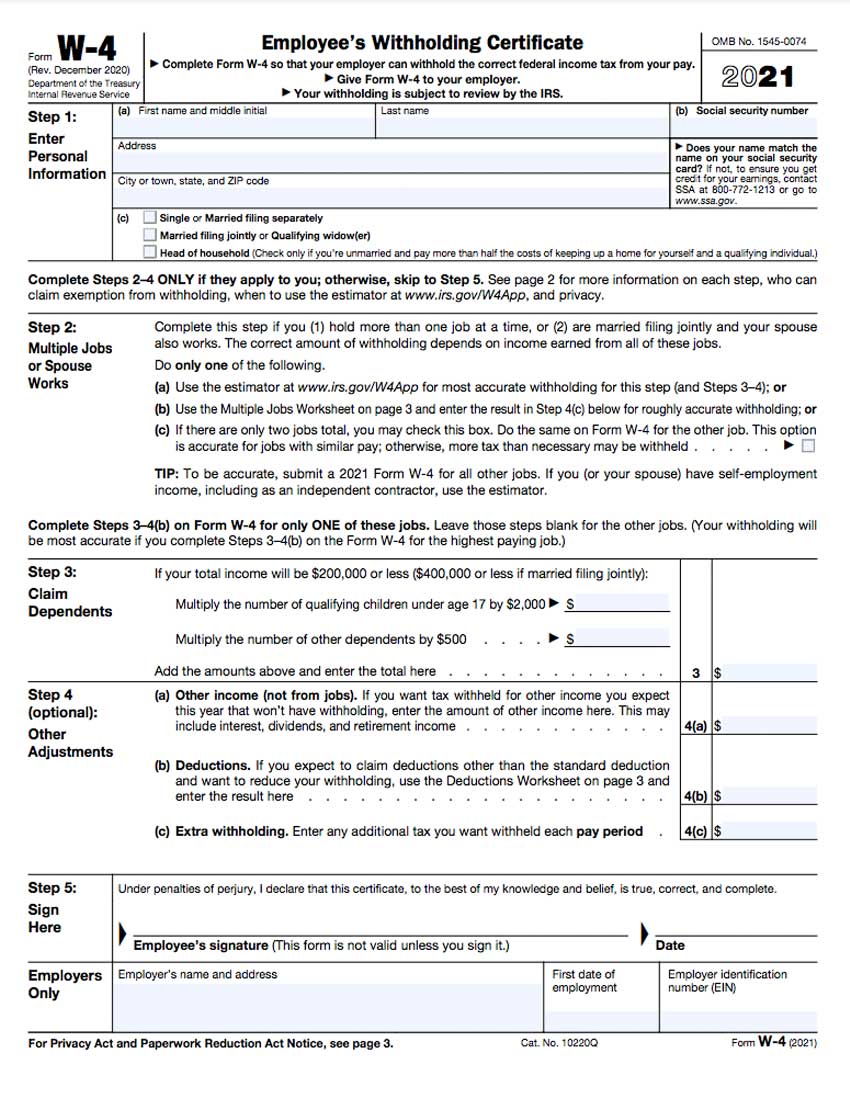

Form W-4

As an Exchange Visitor on a J-1 Visa, you are considered a “Non-Resident Alien” for tax purposes. When filling out the current W-4 form it is recommended that InterExchange Work & Travel USA participants follow Supplemental Form W-4 Instructions for Nonresident Aliens as provided by the IRS.

Depending on how long you work and how much money you earn, you may be eligible for a refund. You should give your employer a self-addressed envelope with your home country address so that they can mail you your tax forms later. InterExchange staff are not tax professionals. If you have tax questions, please consult a tax professional.

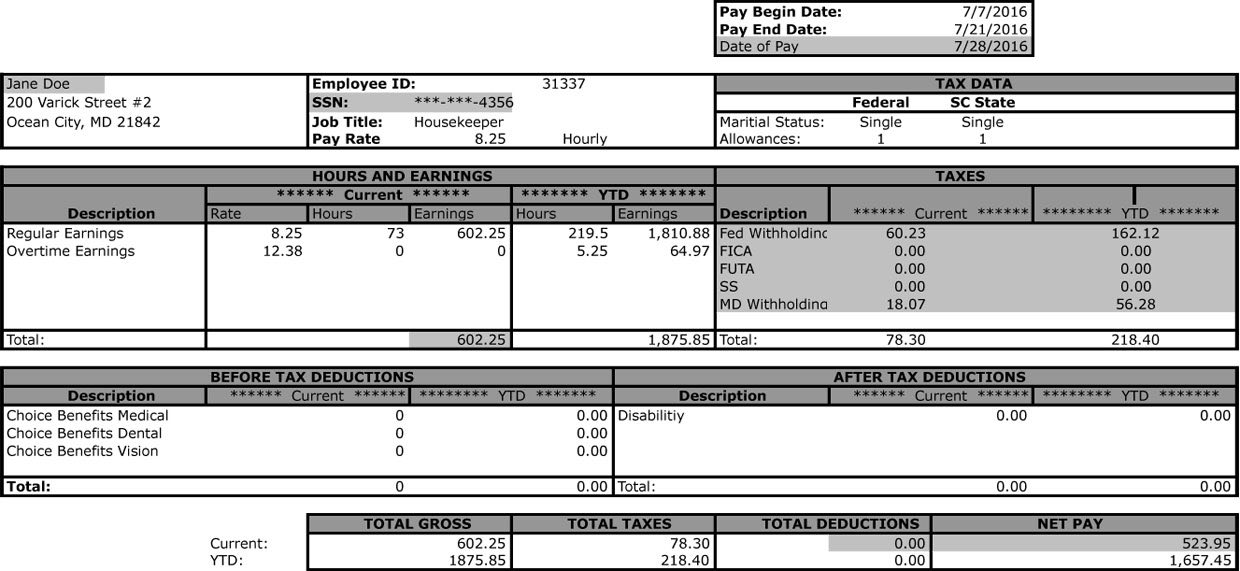

How to Read Your Pay Stub

In order to make sure that you are paying the correct taxes, check your first pay stub:

How to understand your Pay Stub

Gross Pay: Total amount earned in the pay period before any tax deductions.

Withholdings: Amount of money the Federal, State and local governments take out of your paycheck

Net Pay: Total amount of earnings you will receive after taxes have been taken out.

YTD or Year To Date: The total amount of earnings and withholdings since January 1st of the current calendar year.

Please Note:

Before you end your program please give your employer your home address or a self-addressed envelope so that they can mail your W-2 Form to you. If you don’t do so, your employer will not be able to send you the necessary forms to file for your tax return.

Frequently Asked Questions

Do I need to file a tax return?

Yes. If you received payment from your host employer, you will need to file a tax return for each calendar year during which you earned income in the U.S. If you have any specific tax questions, you should contact a tax preparer or call the IRS information line: 1.800.829.1040. InterExchange staff are not licensed tax professionals and are not able to advise you on specific tax-related matters.

When is the tax season?

Each U.S. tax season begins on January 1st and lasts until taxes are due, typically on April 15th. This is the time period during which everyone must file tax returns on the income earned during the previous calendar year. For example, 2024 tax returns will be due to the IRS on April 15, 2025.

What is my tax status?

For tax purposes, J-1 Visa holders are considered non-resident aliens. Please review the IRS’ non-resident alien filing requirements.

Can I use TurboTax or other online tax preparation software to file my taxes?

Unfortunately, no. Unless you e-file with a specific nonresident tax preparer, you must mail paper copies of your tax documents to the IRS. TurboTax does not support non-resident tax forms, and filing as a U.S. resident with online tax software may cause the IRS to suspect you of tax fraud.

What is a ghost preparer?

A “ghost preparer” is an individual or company who prepares and submits your taxes but refuses to sign as the preparer. Be on the lookout for fraud such as this by reviewing information on ghost preparers and other scams on the IRS website.

What is the I-9 and how do I fill it out?

You must complete the I-9 Employment Eligibility Verification Form. This form notifies the U.S. government that you are allowed to work in the United States. You need to show your passport, J-1 Visa, printed I-94 admission record, and DS-2019 Form to your employer when you fill out this form. You are only required to fill out Section 1. Your employer will complete Section 2. Remember to fill out Section 1 using your U.S. work address.

To see an example of how to fill out the I-9 and more information please review these Participant Resources for more information.