Important Tax Information and Tax Forms

Important Tax Information and Tax Forms

As an Exchange Visitor on a J-1 Visa, you are considered a “non-resident alien” for tax purposes. You must complete a tax return and you will likely not receive a refund on the tax you pay. Remember: InterExchange staff are not tax professionals. If you have tax questions, please consult a tax professional.

U.S. law requires that you pay Federal, State and Local Taxes. Your employer will deduct money from your paycheck every pay period. As an income-earning individual, you will be taxed on income from salaries, wages and tips. Your employer will submit the amount withheld directly to the federal government. Deductions for state and local taxes will vary. Some states do not have a personal income tax; others may tax income as much as 8%. Similarly, local taxes will vary but will be significantly less. This means that your paycheck will likely be a little less than the stipend amount in your work contract, since that number presented is pre-tax. That is normal.

Note: You will only be paying income taxes. You do not have to pay Federal Social Security Taxes, Medicare or Federal Unemployment Tax (Please note: some states may deduct state unemployment taxes, which you are required to pay). If your employer has withheld these taxes from your paycheck, please advise them of the mistake and request a refund. To verify that the proper taxes are being withheld from your paycheck, you should review your pay stub (the paper with your wage details that comes with your check). If you see deductions that say FICA, FUTA, S.S. or Social Security, please notify your employer promptly. If your employer is unable to issue a refund, contact the Internal Revenue Service Center and request IRS form 843 “Claim for Refund and Request for Abatement”. You will need to submit the completed IRS forms to the Internal Revenue Service Center.

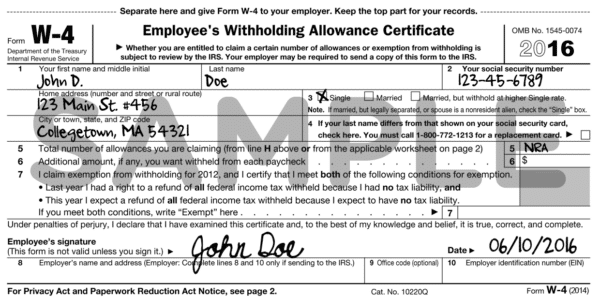

W-4 Form

For tax purposes, you are required to fill out a W-4 Employee Withholding Allowance Certificate as soon as you start working. Your employer will give you a W-4 Form, and it is your responsibility to complete and submit it to your employer. Based on the information you provide on the W-4 Form, your employer will calculate the amount of federal, state and local taxes to be withheld from your paycheck.

How to fill out your W-4

When filling out the current W-4 form it is recommended that InterExchange Camp USA participants follow Supplemental Form W-4 Instructions for Nonresident Aliens as provided by the IRS. Please follow the instructions there. Your employer may tell you to follow the instructions printed on the W-4, but this is not correct. The instructions on the W-4 Form are for U.S. residents.

Below are some instructions from the IRS:

- Step 1(c): Mark or check “Single or Married filing separately”.

- Step 4(c): Write “nonresident alien” or “NRA” in the space below Step 4(c).

- Do not claim that you are exempt from withholding in the space below Step 4(c) of Form W-4 (even if you meet both of the conditions to claim exemption from withholding listed in the instructions to the Form W-4).

Filing Your Tax Return

Step 1: Get Your W-2 Form

At the beginning of the calendar year after your summer of employment, your employer will send you a W-2 Form, which summarizes your earnings and taxes withheld from that year. They are required by law to issue your W-2 to you by February 15th. Before leaving your job, make sure camp has your contact information so they can send it.

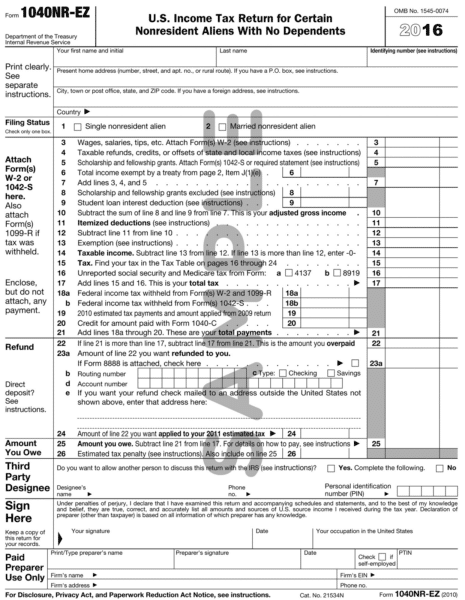

Step 2: Complete the 1040NR Form

Upon receiving your W-2 Form, you’ll need to fill out a 1040-NR (Non-Resident Aliens with No Dependents) tax form.

Make sure to review the Instructions for Form 1040-NR to avoid any mistakes.

If the total amount of money withheld from your paychecks was more than you were required to pay the government, they will issue you a refund. However, if the amount withheld from your pay was less than required, you must pay the government the amount of tax you still owe.

Your tax paperwork must be received by the IRS on or before April 15th of the year following your summer of employment.

Note: In addition to Federal tax withholdings, most states also require that additional taxes be paid to the state. There are separate forms for state and local taxes. The forms and requirements are different for each state. Your employer should be able to help you locate the necessary forms online.

Step 3: Mail in Your Forms

Once you have completed the forms, mail them to the address on the 1040-NR instructions or use an e-file service, if available.

Before mailing in your tax return:

Keep a copy of all your documents including the tax return and check.

If you are enclosing a payment, mail your payment and the Form 1040-NR to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

If you are not enclosing a payment mail your forms to:

Department of Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

If you are owed a refund, you will be given a paper check issued by the U.S. Government. Keep in mind that you may not be able to cash this check in your home country.

You may have the option to receive a refund via direct deposit, but this needs to be done before the refund is issued. In order to be eligible for direct deposit, you will need a U.S. bank account.

Speak with your U.S. bank and your home country bank to determine what options you have.

Please note: InterExchange staff are not tax experts and do not provide tax advisory services. The information provided here is merely a reminder to participants about basic information needed to file taxes and other resources available to them.

Frequently Asked Questions About Taxes

Will taxes be deducted from my paycheck?

Yes. U.S. law requires that you pay federal, state, and local taxes. Generally, your employer will deduct money from your paycheck every pay period. As an income-earning individual, you will be taxed on income from stipends, wages, and tips. Your employer will submit the amount withheld directly to the federal government. Deductions for state and local taxes will vary. Some states do not have a personal income tax; others may tax income as much as 8%. Similarly, local taxes will vary but will be significantly less. If no taxes are withheld from your pay, please contact InterExchange.

You do pay:

- Federal income tax

- State income tax

- Local or city income tax

You do not pay:

- Social Security (S.S.)

- Medicare tax (FICA)

- Federal Unemployment Tax (FUTA)

Can I get a refund for the taxes that were taken out of my paycheck?

No, you will only get a refund if you had too much deducted. You will not get a full refund for the taxes that were deducted from your paychecks. Anyone who works in the U.S is required to pay taxes regardless of the amount earned.

What if I return home without receiving a Social Security number?

As long as you have earned income in the U.S. you are still required to file a tax return for the year(s) during which you worked. If you have not been able to receive an SSN but do need to file a tax return, you can apply for an Individual Taxpayer Identification Number (ITIN) alongside your tax return by following the steps below.

Note: If you have a Social Security Number you will not need to apply for an ITIN

When mailing your application, alongside your Federal tax return, make sure to follow the IRS instructions and include the following:

- 1040-NR (Your Federal tax return)

- ITIN application (Form W-7, signed). The reason should be “B – Nonresident Alien Filing a U.S. Federal Tax Return” in the case that you have been unable to attain an SSN but need to file a tax return.

- Attach a certified copy of your passport.

- If including a photocopy of your passport, it must be certified by one of the following:

- Certified Acceptance Agent or IRS official

- The governmental department that issued the identification document (e.g., Home country passport office).

- The United States Embassy or Consulate (make a reservation before visiting).

- If including a photocopy of your passport, it must be certified by one of the following:

Get started today

It’s free to start an application and nothing is due until you accept a job offer.