Social Security Numbers & Taxes

Social Security Numbers & Taxes

All paid interns and trainees are required to apply for a Social Security Number. If you are not providing any payment to the participant, he or she is not required to have a Social Security number, but we recommend that participants apply for one, as they may need it for opening a bank account, renting an apartment, or applying for a U.S. driver’s license.

The wait time to receive a card may take up to 6 weeks.

IMPORTANT: Participants may begin to intern/train and be paid before they have been issued a Social Security Number as long as they provide you the application receipt letter.

Please visit the Social Security website or see our tips below for more information on how to set up your participant’s payroll prior to receipt of their SSN.

Applying for a Social Security Number

To apply for a Social Security number, participants must follow the steps below:

1. Inform InterExchange of their arrival in the U.S.: To avoid delays in obtaining a Social Security number, please remind participants to contact InterExchange Career Training USA immediately upon arrival in the U.S. to activate their SEVIS record—participants will not be able to get a Social Security number without an active SEVIS record.

2. Wait at least 5 business days: We recommend waiting at least 5 business days after SEVIS activation before applying for a Social Security Number, as it sometimes takes a few days for SEVIS information to be updated in the Social Security Administration’s database.

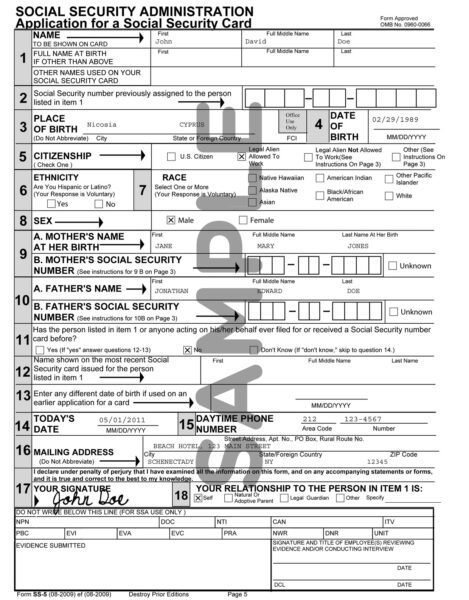

3. Complete the Social Security application: Participants may be eligible to begin their application online and then bring any required documents to their local SSA office to complete the application. Participants should visit the Social Security Number and Card webpage and answer the questions to determine if they are eligible to start the application process online.

If assisting participants with their applications, please use the following tips:

- Use your company address as the mailing address, especially if participants have not yet arranged permanent housing

- For an online application:

- For the question regarding the documentation the participant will provide, they should select Foreign Passport, I-94 with Unexpired Foreign Passport, DS-2019 Certificate of Eligibility, and Other.

- Participants should print and save the online control number page once they complete the online application

- For a paper application:

- For the question regarding CITIZENSHIP, check the box labeled “Legal Alien Allowed To Work”

- The questions regarding mother and father’s Social Security Numbers can be left blank

4. Visit a local Social Security Office to apply in person: If participants submit an online application, they must visit their local SSA office with their original documentation within 45 calendar days. To facilitate the application process, we recommend assisting participants with locating a Social Security Administration Office. Use the Social Security Office Locator, to find the closest office. Most Social Security offices are only open Monday through Friday from 9:00 am – 4:30 pm and are busiest between the hours of 11:00 a.m. – 2:00 p.m.

When applying for a Social Security number, participants must bring the following items:

- Social Security application (if they did not begin their application online)

- Printed online control number page from their Social Security application (if they submitted an online application)

- Passport, including the J-1 Visa

- DS-2019 Form

- Printout of I-94 Arrival/Departure Record

- ‘Dear Social Security Officer’ letter

Sample Social Security Application form

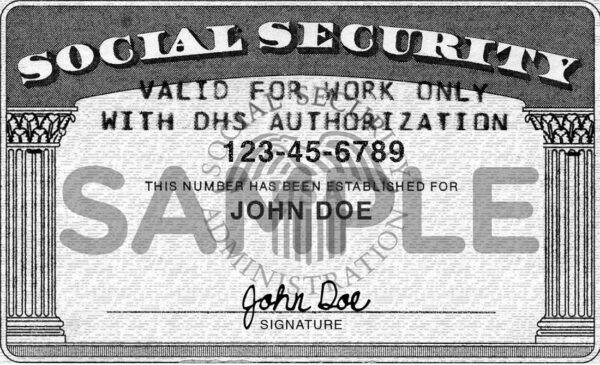

Sample Social Security Card

5. Ask for participants’application receipt: Instruct participants to keep the application receipt provided to them by the Social Security office. They should make a copy for their own records and provide you with the original. This allows participants to start training and be paid before their SSN is issued.

Read about 8 Quick Ways You Can Help Participants Get Their Social Security Number to avoid any mistakes or delays.

If you or your participants have any questions, please call the Social Security Administration’s toll-free number: 1.800.772.1213. Or, visit their website at: www.ssa.gov.

Pay & Tax withholdings

If you are offering a paid internship or training program, participants should typically be paid on the same schedule as your full-time employees. They must also be paid as regular employees and not as independent contractors (i.e. do not use IRS form 1099-misc).

All paid interns and trainees are required to pay income tax, but they’re exempt from certain other taxes. Please review the table below:

| Taxes to Pay: | Taxes to NOT Pay: |

|---|---|

| Federal Income Tax | Medicare Tax (FICA) |

| Local or City Income | Social Security Tax (S.S.) |

| State Income Tax | Federal Unemployment Tax (FUTA) |

As you can see, J-1 program participants do not pay Social Security, FICA, or FUTA Withholdings.

Under IRS Code Section 31.21. (B)(19), all non-resident aliens on J-1 visas are exempt from paying FICA (Social Security) and FUTA (federal unemployment taxes) taxes during their first two calendar years in the U.S. Since all of J-1 interns and trainee participants are only able to intern/train for 18 months or fewer, all are exempt from these withholdings. Please consult a tax professional to see if your participants are also exempt from state unemployment taxes in your state.

If FICA/FUTA has been withheld from your participants’ pay by mistake, please be sure to adjust the withholding amount for all future pay periods and issue a refund.

Onboarding Forms

I-9 Form

When participants arrive at your company, they must complete an I-9 Employment Eligibility Verification Form, which notifies the Federal Government that they are allowed to work in the United States. Participants will show you their:

- Passport with J-1 Visa

- I-94 Arrival/Departure Record

- DS-2019 Form

Participants will complete Section 1, using your company address, and you will complete Section 2.

If your company uses E-Verify, note that participants must have a Social Security number (SSN) in order to be verified. If your participant has not yet received a Social Security number, make a note on their Form I-9 and set it aside. The participant is still allowed to continue to train. Once your participant receives a number, you can create a case in E-Verify. More information can be found on the E-Verify website:

Employees must have a Social Security number (SSN) to be verified using E-Verify. If an employee has applied for but has not yet received his or her Social Security number (i.e., if he or she is a newly arrived immigrant), make a note on the employee’s Form I-9 and set it aside. The employee should be allowed to continue to work. As soon as the Social Security number is available, the employer can create a case in E-Verify using the employee’s Social Security number.

W-4 Form

Participants must also fill out a W-4 Employee Withholding Allowance Certificate as soon as they start a paid internship/training program. Based on the information provided on the W-4 Form, you must calculate the amount of federal, state, and local taxes to be withheld from the paycheck. Remember, J-1 participants are exempt from FICA/FUTA taxes, and these should not be withheld from their paychecks.

InterExchange Career Training USA participants are exchange visitors in the “non-resident alien” tax category. Please consult a tax professional for the most recent tax regulations.

When completing the W-4 Form, participants should NOT follow the instructions printed on the form, which are specific to U.S. residents—not exchange visitors.

How to Complete the W-4 Form:

As a non-resident, your participant should follow the instructions below. You can also view these instructions from the IRS online.

How to Complete the W-4 Form:

The participant should NOT follow the instructions printed on the form, as the instructions on the W-4 Form are for U.S. residents—not exchange visitors.

As a non-resident, please have the participants follow the instructions below. You can also check out the special instructions for nonresident aliens issued by the IRS online.

Do not complete the Personal Allowances Worksheet; this does not apply to exchange visitors.

Step 1(a): Indicate your legal name and permanent U.S. mailing address.

Step 1(b): Enter your Social Security number if you already have it. If you do not have your number yet, inform human resources at your host company that you applied for a number and provide a copy of your receipt.

Step 1(c): Mark or check “Single or Married filing separately,” even if you are married.

Steps 2 & 3: Leave blank.

Step 4: Write “nonresident alien” or “NRA” in the space below Step 4(c).

Step 5: Sign and date your form

If your participants have not yet received their Social Security Number, follow these instructions provided by the IRS:

- Paper Filers: If the participants applied for a card but didn’t receive the number in time for filing, enter “Applied For” in Box a. (Reference: IRS Instructions for Forms W-2/W-3)

- Electronic Filers: If the participants applied for a card but didn’t receive the number in time for filing, enter all zeros in the field for the Social Security number. (Reference: Specifications for Filing Forms W-2 and W-2c Electronically)

Remember to instruct participants to tell you the number and the exact name printed on the card when they receive it.

Filing Taxes

All program participants who are paid must file a U.S. tax return for the calendar year during which they trained with your company and follow the tax filing deadline for that year. Even if participants are no longer in the U.S., they must file a U.S. tax return for the time they trained. Reminding participants of this tax filing requirement is essential, especially if their program spans more than a year’s tax period.

Filing taxes as a non-resident alien differs from filing as a U.S. citizen or resident. You can find tips below on assisting your participants with their taxes.

Please also encourage your participants to visit the Tax Information page within our participant resources.

NOTE: If the participant has specific questions, they should contact the IRS or a tax professional, as InterExchange is not certified or licensed to provide individualized tax advice.

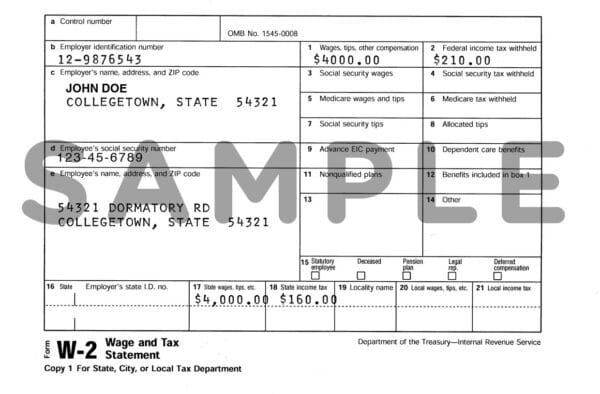

W-2 Form

If participants are still in the U.S. at tax time, please provide them with a W-2. If they have already returned home by the time W-2s are issued, we recommend that you have them leave a self-addressed envelope before departing the U.S. so that you will be able to mail the W-2 at the appropriate time or ensure that they continue to have access to an electronic W-2.

You must send a W-2 Form to your participant between January 1st and January 31st, documenting their wages and deductions from the prior calendar year.

NOTE: Do not send W-2 forms to our New York office. We are not responsible for getting this information to participants and cannot guarantee that they will receive it.

Filing Form 1040NR

If participants will still be in the U.S. at tax time, you may wish to assist them with filing a tax return. Upon receiving the W-2 Form, participants will need to fill out a 1040NR (Non-Resident Aliens) tax form.

NOTE: There are limited e-file options for non-resident aliens. J-1 participants must complete a paper copy of the form 1040-NR and mail it to the proper IRS branch. They may not use e-file options like TurboTax which are meant for U.S. residents only.

Once the form is completed, it should be mailed to the IRS address listed in the “Where to File” section of the 1040-NR instructions.

Further resources:

- IRS Website

- IRS Guide for Taxation of Non-Resident Aliens

- Interactive Tax Assistant

Filing an Amended Tax Return

If the participant has made an error on a previously filed tax return, they must file an amended tax return or Form 1040-X.

The most common error J-1 participants make is filing the wrong tax form. If they filed with TurboTax, for example, they probably filed Form 1040, which is for U.S. citizens and residents, rather than Form 1040-NR, which is for non-resident aliens like J-1 participants. The participants will need to file Form 1040-X along with a new 1040-NR to correct their return.

Once complete, they’ll need to mail the corrected forms to:

Department of the Treasury Internal Revenue Service Austin, TX 73301-0215

IRS Contact

Social Security Contact

Employer Responsibilities When Hiring Foreign Workers

www.ssa.gov/employer/hiring.htm