Tax Information

How to File a Tax Return

- Tax Information

- Tax-Related Forms

- How to File a Tax Return

- Frequently Asked Questions About Taxes

How to File a Tax Return

As an exchange visitor on a J-1 Visa, you are considered a non-resident alien for tax purposes. All J-1 participants who receive payment during their internship or training program have a tax filing requirement and will need to file at least one form with the IRS during tax season.

The Internal Revenue Service (IRS) is the U.S. government agency that collects taxes. You can get forms, instructions, and information from their website.

Depending on the length of your internship and your compensation, you may be eligible for a refund of some of the taxes you paid. Your tax return will show your earnings for the previous year, the taxes you paid, and the total amount of taxes owed or refunded.

NOTE: InterExchange staff are not licensed tax experts and therefore cannot provide tax advisory services. The information provided here is merely a reminder to participants about basic information needed to file taxes and other resources available to them.

Step 1: Complete Form 8843

All non-resident aliens must file Form 8843. This isn’t a tax return but rather lets the IRS know how many days you were outside of the U.S. during the calendar year. This helps them determine your tax responsibility in the U.S.

You must complete and submit Form 8843 regardless of if you were paid or unpaid during your internship. J-2 dependent visa holders also need to submit this form.

Unpaid Internships

If you were unpaid during your internship, mail a paper copy of your completed Form 8843 by April 15 to:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

Paid Internships

If you were paid by your U.S. host employer, you will attach and mail Form 8843 along with your tax return to the appropriate IRS location. Follow the steps below for completing your tax return.

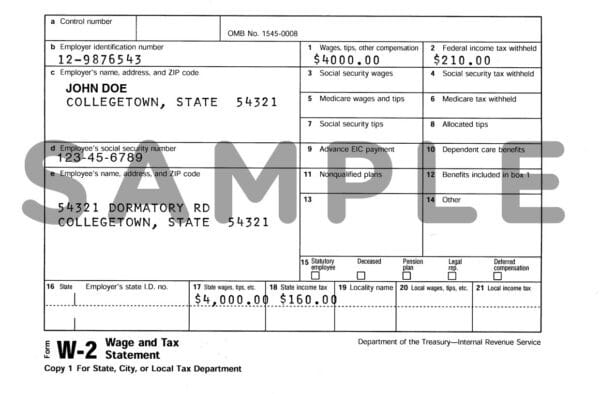

Step 2: Get Your W-2 Form

The W-2 Form summarizes your earnings and the taxes withheld from your earnings during the previous year.

Your employer must send you a W-2 Form between January 1st and January 31st, documenting your wages and deductions from the prior calendar year (if they are mailing it, your form must be mailed by January 31st, but you may receive it later).

If you do not receive your W-2 form from your employer by mid-February, contact your employer immediately.

IMPORTANT: Before you leave the U.S., please ensure your host employer has your home country contact information so that they can send your W-2 form to you after you depart. If you do not do so, your employer will not be able to send you the necessary forms to file for your tax return.

NOTE: Participants whose program dates span multiple calendar years will receive multiple W-2 Forms and will need to file taxes for each year in which wages were earned. For example, if your internship/training program lasts from September 2024 to April 2025, you will receive a W-2 in January 2025 for wages earned in 2024, then another W-2 will be sent to you in your home country in January 2026 for wages earned in 2025.

Step 3: Complete Form 1040NR

2024 Tax Year Filing Dates

The paperwork for your 2024 taxes must be postmarked and mailed on or before April 15, 2025. Hint: The sooner you file, the sooner you can receive your tax refund!

How to File

There are limited e-file options for non-resident aliens. Unless you pay to e-file with a nonresident tax preparer, you must complete a paper copy of the form 1040-NR and mail it to the proper IRS branch. You may not use common tax preparation software such as TurboTax, which only supports Form 1040 and is meant for U.S. residents only. If you do use online software like TurboTax, you will incorrectly file as a U.S. resident, and doing so may cause the IRS to suspect you of tax fraud (even if this was unintentional).

Filing Instructions

Upon receiving your W-2 Form, you will fill out a 1040-NR (Non-Resident Alien) tax form. You also need to fill out the accompanying document, Schedule OI. When you begin the 1040-NR Form and Schedule OI, make sure to read the instructions pamphlet and follow the instructions carefully. You will need the instructions for form 1040 for details on how to complete each line, but should refer back to the instructions for form 1040-NR for any possible exceptions. Remember: Make sure you complete form 1040-NR, which is specifically for non-resident aliens, and not form 1040, which is for U.S. citizens and residents.

If you overpaid the U.S. government, they will issue you a refund. However, if you did not pay enough taxes, you must pay the government the amount you still owe.

State Taxes

There are separate forms for state and local taxes, but they vary by state. Visit your host state’s department of revenue website for state tax forms and instructions. The IRS website also has more information on filing for taxes in your host state.

Tax Treaties

Some countries have agreements with the U.S. government that affect the tax rate that their nationals must pay. If your country has a tax treaty with the U.S., you should indicate this when you file your taxes to get the adjusted tax rate.

J-2 Taxes

J-2 visa holders must also file taxes if they are over 18 or have earned money while in the United States.

NOTE: The 2018 Tax Cuts and Jobs Act (TCJA) includes changes to the federal income tax law that may affect some exchange visitors. The new federal income tax law, which was implemented in 2019, eliminates the personal exemption of $4,050 when filing Form 1040-NR for nonresident aliens. This may affect exchange visitors’ refund of wages withheld for federal income tax and may consequently increase the cost of Exchange Visitor Program participation.

Step 4: Mail in Your Forms

Once complete, you must mail physical copies of your 1040NR to the IRS. Unfortunately, there are limited e-file options for nonresident aliens and filing your tax returns electronically is typically not an option. Don’t forget to include Schedule OI and Form 8843 with your return.

Make copies of all forms and checks prior to mailing them! We also recommend using a registered mail service with tracking options to ship your documents.

If you are enclosing a payment, mail your payment and the Form 1040NR to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

USA

If you are not enclosing a payment, mail your forms to:

Department of Treasury

Internal Revenue Service

Austin, TX 73301-0215

USA

Step 5: Receive Your Refund (if applicable)

If you are owed a refund, you will indicate your preferred payment method on your tax return. You may either receive the funds via direct deposit to a U.S. bank account or you can request that a paper check be shipped to an address outside of the U.S.

Receiving the funds via direct deposit is the quicker option, but the IRS will not transfer funds to an overseas bank account. It may also be difficult to cash a paper check from the U.S. in your home country. Therefore, it may be in your best interest to leave your U.S bank account open until after you’ve received your tax refund. Speak with your U.S. bank and your home country bank to determine which option works best for you.

Filing an Amended Tax Return

If you made an error on a previously filed tax return, you’ll need to file an amended tax return, or Form 1040-X.

The most common error J-1 participants make is filing the wrong tax form. If you filed with TurboTax, for example, you probably filed Form 1040, which is for U.S. citizens and residents, rather than Form 1040-NR, which is for non-resident aliens like J-1 participants. You’ll need to file Form 1040-X along with a new 1040-NR to correct your return.

Once complete, mail your corrected forms to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

Don’t forget to amend your state returns as well. Visit the government website for the state you filed in to get more information on how to amend your return.

Tax Scams

When preparing your tax documents, be cautious of individuals or companies offering to file your tax returns for you. Tax fraud and scams are not uncommon. Be on the lookout for warning signs of “ghost preparers,” those who file returns but refuse to sign the document as the preparer. Review information on the IRS website about other common tax scams and how to report them.

Additional Tax Resources

InterExchange is not a licensed tax preparer; if you have specific questions, we recommend contacting the IRS directly. You may also contact a tax provider who could assist you with your individual situation, typically for a flat fee or a percentage of your tax refund. Make sure you tell them beforehand that you are a J-1 Intern/Trainee (non-resident alien) and be mindful of any fees they may charge.

You are also encouraged to use the following resources as you plan to file your taxes: