Social Security Number

About Your Social Security Number

Since you will be working in the U.S., you will first need to apply for a Social Security card. If you already have a Social Security number you do not need to apply again. Make sure to bring your card with you to the U.S.

Important: You will not be issued a Social Security number if you do not register in SEVIS. You must register as soon as you arrive in the U.S. Participants need to wait at least 3-4 business days after registering in SEVIS before applying for a Social Security number.

Important: After you apply, it may take 4 to 6 weeks for your Social Security Card to arrive. You are allowed to work while you are waiting for your card. If your employer has questions about your eligibility to work because your card hasn’t arrived, ask him or her to call InterExchange at 1.800.621.1202.

If you need to apply for a first-time Social Security card, you must first fill out the Online Social Security Number Application.

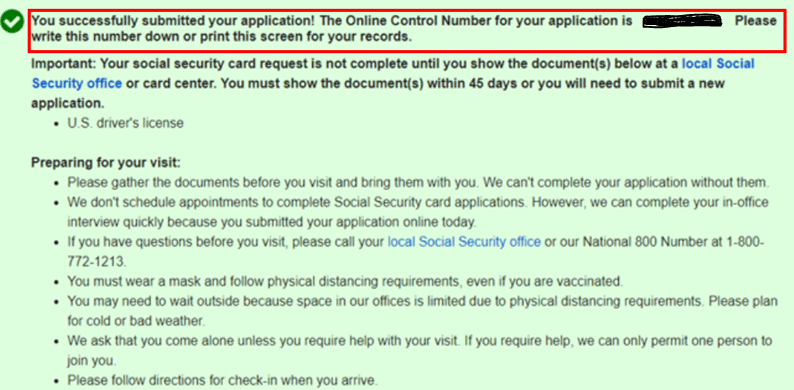

After you submit your online request, you must visit your local SSA office in-person with your documentation (see below) within 45 calendar days. Use the Social Security Office Locator to find the closest office. Once your Online Social Security Number Application has been submitted, you will receive a successful submission confirmation page that includes a unique Online Control Number. You will need to take a screen capture of this confirmation page or print it out to bring with you to your local Social Security office. It is important that you have the Online Control Number when you arrive to finish your application in-person.

You must also bring the originals AND two photocopies each of the following documents:

- Photo page of passport

- Visa page of passport with admission stamp

- DS-2019 Form (make a photocopy of both front and back)

- Dear Social Security Officer Letter

Important: When you apply for your Social Security Number (SSN) you will get a receipt letter. Make a copy of it for your personal records. Give the original receipt letter to your employer when you arrive. The receipt is proof that you have applied for a Social Security number.

Remember! Read all instructions BEFORE you fill out the application. Here are some tips:

- It is important to have a valid, dependable mailing address or an ‘in care of’ address to receive the card, before completing and submitting the Online Application. This will prevent you having to visit the SSA office multiple times for non-receipt issues. The post office cannot deliver the card if the applicant is unknown at the address.

- You may use your host employer’s physical address as your mailing address, including the name of your host employer’s business.

- If you are using your U.S. housing address, make sure that your full name is on the mailbox. If your full name is not on the mailbox or if a c/o (care of) is not included for a PO Box Address the Post Office will not deliver the Social Security card.

Applying at a Social Security office

Most Social Security offices are only open Monday to Friday from 9:00 a.m. – 4:00 p.m. If possible, you may want to avoid the busy hours from 11:00 a.m. – 2:00 p.m.

Social Security Application Process

SSA = Social Security Administration

Use the Social Security Office Locator at https://secure.ssa.gov/ICON/main.jsp to find your closest office. You’ll need to bring the originals AND two photocopies of the following documents:

- Photo page of passport

- Visa page of passport with print out of I-94 record

- Dear Social Security Officer Letter

- Printed DS-2019 Forms that are signed using digital software (make a photocopy of both front and back)

- On July 20, 2023 the Social Security Administration published this directive to all offices to accept printed Forms DS-2019 that are signed using digital software or printed and signed in ink.

Take detailed notes regarding what the SSA officer says and call InterExchange.

Call SSA to check status and inform InterExchange.

SSA:1.800.772.1213

InterExchange:

1.800.597.1722

Checking your application status

After you apply for your Social Security number, we recommend checking on your application status after seven to ten days. If you return to the office at which you applied, take all of your original documents as well as the receipt of application. Checking on your application status can minimize any delays or problems with your application. Your Social Security number may even be available to you prior to your card being mailed out. If you have any questions, please call the Social Security Administration’s toll-free number: 1.800.772.1213.

After you receive your Social Security number

It is your responsibility to notify your employer as soon as you receive your Social Security number. Your employer may ask to make a copy of your Social Security card (they will need the number for tax purposes), but you should retain the original card and keep it in a safe place. Do not laminate your card.

Protect Your Personal ID and Confidential Information

Your Social Security number is a lifelong number that is yours alone. Do not allow others to use your number. Record your number in a safe place in case your card is lost or stolen. Protect both your card and your number to prevent misuse.

If you have any questions or lose your card, please call the Social Security Administration’s toll-free number, 1.800.772.1213, or visit their website. You can also call InterExchange for guidance at 1.800.621.1202.

Social Security Locations

If there is no Social Security office close to your job site, you may consider applying for your number upon arrival in the U.S., in one of the major cities (New York, Chicago, Boston, etc.). If this is the case, you should prepare all documents prior to your arrival. Since people normally apply for Social Security cards near their place of employment, an officer may tell you to wait and apply once you have reached your job site. You may explain that there is no Social Security office near your job site. Therefore, you should apply in your arrival city. If the officer seems unsure about doing this, politely ask for a supervisor or the manager.

To locate the nearest office, check the Social Security Administration’s website.

Contacts

Resources

Frequently Asked Questions

Why do I need a Social Security number?

Social Security numbers are generally assigned to people who are authorized to work in the United States. They are used to report your wages to the government and to identify you when filing your tax return. Also, when opening up a new bank account, most banks require either a Social Security number or proof of application for a Social Security number.

How long will it take to receive my Social Security card?

Your Social Security card should arrive in the mail within six weeks of your application date. It is important that your mailing address on Form SS-5 is accurate to ensure that your card gets delivered to you. If you change your mailing address after you submit your application to the Social Security office, it is your responsibility to inform the Social Security Administration of this change by calling or visiting any Social Security office. If you do not currently have a valid mailing address, you may list your employer’s address as your mailing address.

If I am a returning J-1 participant and have already been issued a Social Security number, do I need to reapply?

No, you do not need to apply for a new number. If you do not remember your number or have lost your card, you will need to apply for a replacement by visiting your local Social Security office: www.ssa.gov/locator.

What if the Social Security Administration won’t accept my documents?

The Social Security Administration (SSA) will not accept a student’s application and documents if you have not yet registered in SEVIS. We recommend going to the Social Security office at least five business days after activating your SEVIS record and at least 10 days after your arrival. If SSA does not accept your application, take detailed notes of what the Social Security officer says and report this information to InterExchange by calling 1-800-621-1202.

What if my Social Security card never arrives?

If you put your employer’s address on the Social Security application Form SS-5, first check with them to ensure that they have not already received your card. If they have not, call the Social Security Administration at 1-800-772-1213. An update on your application status will usually be given over the phone. In the event that there is an issue with the application, take detailed notes and call InterExchange to help resolve the issue. You can also reapply in person at your local Social Security office, which can be found at: www.ssa.gov/locator.

What if I have difficulty using the Online Social Security Number Application?

The Online Social Security Number Application will speed up the application process when you arrive in-person to show the Social Security officer your documents and finish the application. If you are unable to submit your Online Social Security Application, you can bring a completed Form SS-5 (paper application form) with you to your local Social Security office.

What if I return home without receiving a Social Security number?

As long as you have earned income in the U.S. you are still required to file a tax return for the year(s) during which you worked. If you have not been able to receive an Social Security Number but do need to file a tax return, you can apply for an Individual Taxpayer Identification Number (ITIN) alongside your tax return by following the steps below. Note: If you have a Social Security Number you will not need to apply for an ITIN.

When mailing your ITIN application together with your Federal tax return, make sure to follow the IRS instructions and include the following:

- 1040-NR (Your Federal tax return)

- ITIN application (Form W-7, signed). The reason should be “B – Nonresident

- Alien Filing a U.S. Federal Tax Return” in the case that you have been unable to attain an SSN but need to file a tax return.

- Attach a certified copy of your passport.

If including a photocopy of their passport, it must be certified by one of the following:

- Certified Acceptance Agent or IRS official

- The governmental department that issued the identification document (e.g., Home country passport office).

- The United States Embassy or Consulate (make a reservation before visiting).