Tax Information

Forms

Tax-Related Forms

I-9 Form

When you arrive at your host employer, you must complete an I-9 Employment Eligibility Verification Form, which informs the federal government that you are permitted to work in the United States. You will need to show your passport, a printout of your I-94 Arrival/Departure Record, J-1 Visa, and DS-2019 Form to your employer when completing this form. You will complete Section 1, and your host employer will complete Section 2. You should fill out Section 1 using your host employer’s address.

W-4 Form and What You Should Pay

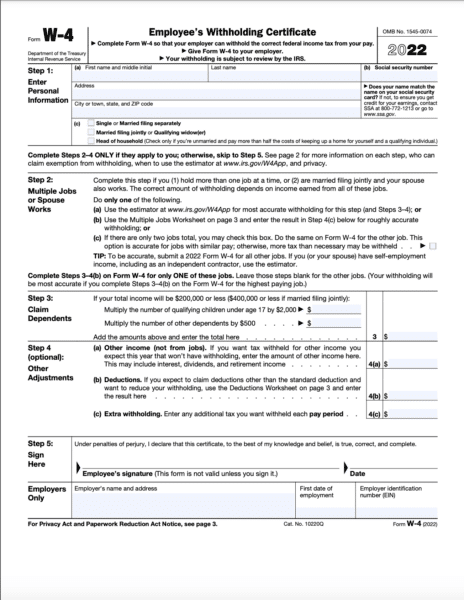

Your employer will give you a W-4 Form upon arrival, and it is your responsibility to complete and submit this to your employer. Based on the information you provide, your employer will calculate the amount of federal, state, and local taxes that will be withheld from your paycheck.

How to How to Fill Out Your W-4 Form

Your employer may tell you to follow the instructions printed on the form, but this is not correct. The instructions on the W-4 Form are for U.S. residents only. As a non-resident, please follow the instructions below. You can also check-out the special instructions for nonresident aliens issued by the IRS online.

- Do not complete the Personal Allowances Worksheet; this does not apply to exchange visitors.

- Step 1(a): Indicate your legal name and permanent U.S. mailing address.

- Step 1(b): Enter your Social Security number if you already have it. If you do not have your number yet, inform human resources at your host company that you applied for a number and provide a copy of your receipt.

- Step 1(c): Mark or check “Single or Married filing separately,” even if you are married.

- Steps 2 & 3: Leave blank.

- Step 4: Write “nonresident alien” or “NRA” in the space below Step 4(c).

- Step 5: Sign and date your form.