Tax Information

If you will be paid at your internship/training program, U.S. law requires that you pay federal, state, and local taxes. As an income-earning individual, you will be taxed on income from your salary or stipend.

Your employer will submit the amount withheld from each paycheck directly to the federal government. Deductions for state and local taxes will vary. Some states do not have a personal income tax; others may tax income as much as 8%. Similarly, local taxes vary, but they are typically less than state and federal taxes.

If no taxes are withheld from your paycheck, please contact InterExchange.

You do pay:

- Federal Income Tax

- Local or City Income

- State Income Tax

You do not pay:

- Medicare Tax (FICA)

- Social Security Tax (S.S.)

- Federal Unemployment Tax (FUTA)

You do not have to pay Social Security or Medicare Tax. You also will not pay federal unemployment taxes, but some states may deduct state unemployment taxes, which you are required to pay.

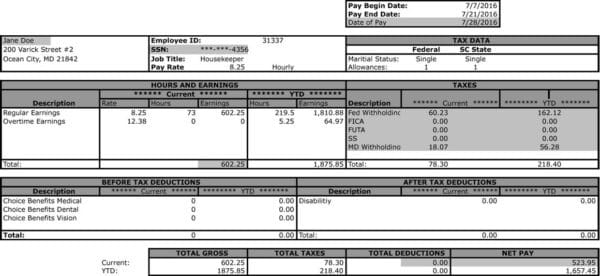

How to Read Your Paycheck

In order to make sure that you are paying the correct taxes, check your first pay stub:

How to understand your Pay Stub

Gross Pay: Total amount earned in the pay period before any tax deductions.

Withholdings: Amount of money the Federal, State and local governments take out of your paycheck

Net Pay: Total amount of earnings you will receive after taxes have been taken out.

YTD or Year To Date: The total amount of earnings and withholdings since January 1st of the current calendar year.

Important: If you see deductions that say FICA, FUTA, S.S., or Social Security, please notify your employer promptly. If your employer is unable to issue a refund, contact the Internal Revenue Service – the U.S. government agency that collects taxes – and request IRS Form 843, Claim for Refund and Request for Abatement. You will need to submit the completed IRS forms to the Internal Revenue Service Center. Please note: Some states may deduct state unemployment taxes, which you are required to pay.